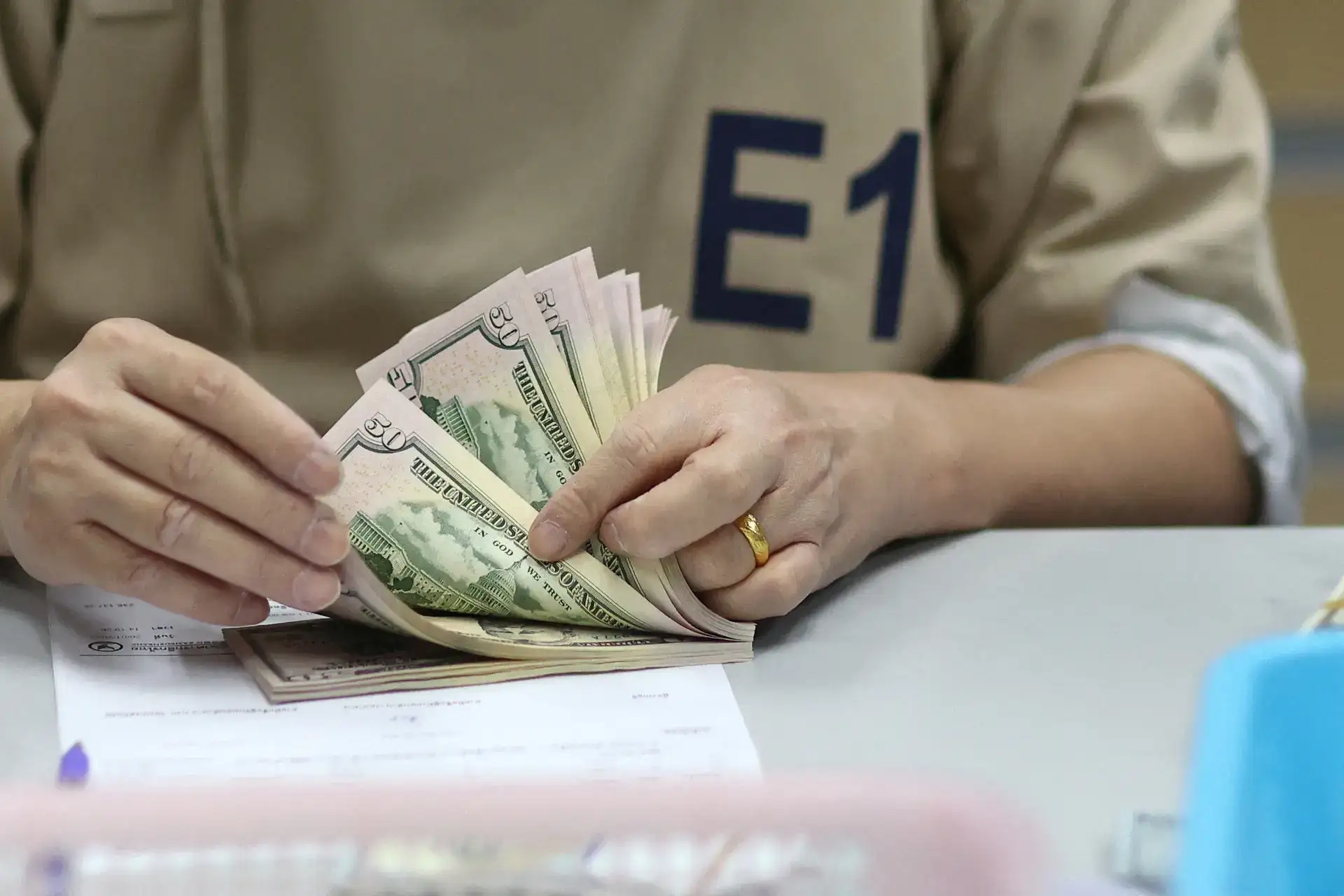

Why your year-end bonus looks lighter this year — taxes, fees and hidden deductions explained

Bonus tax withholding: Americans opening year-end bonus statements face a shock. A large chunk of extra pay vanishes immediately due to tax rules. Bonuses are treated as supplemental income, triggering high federal and payroll tax withholdings. This can leave workers with much less than anticipated, impacting holiday spending plans. Retirement contributions can help reduce this tax burden.