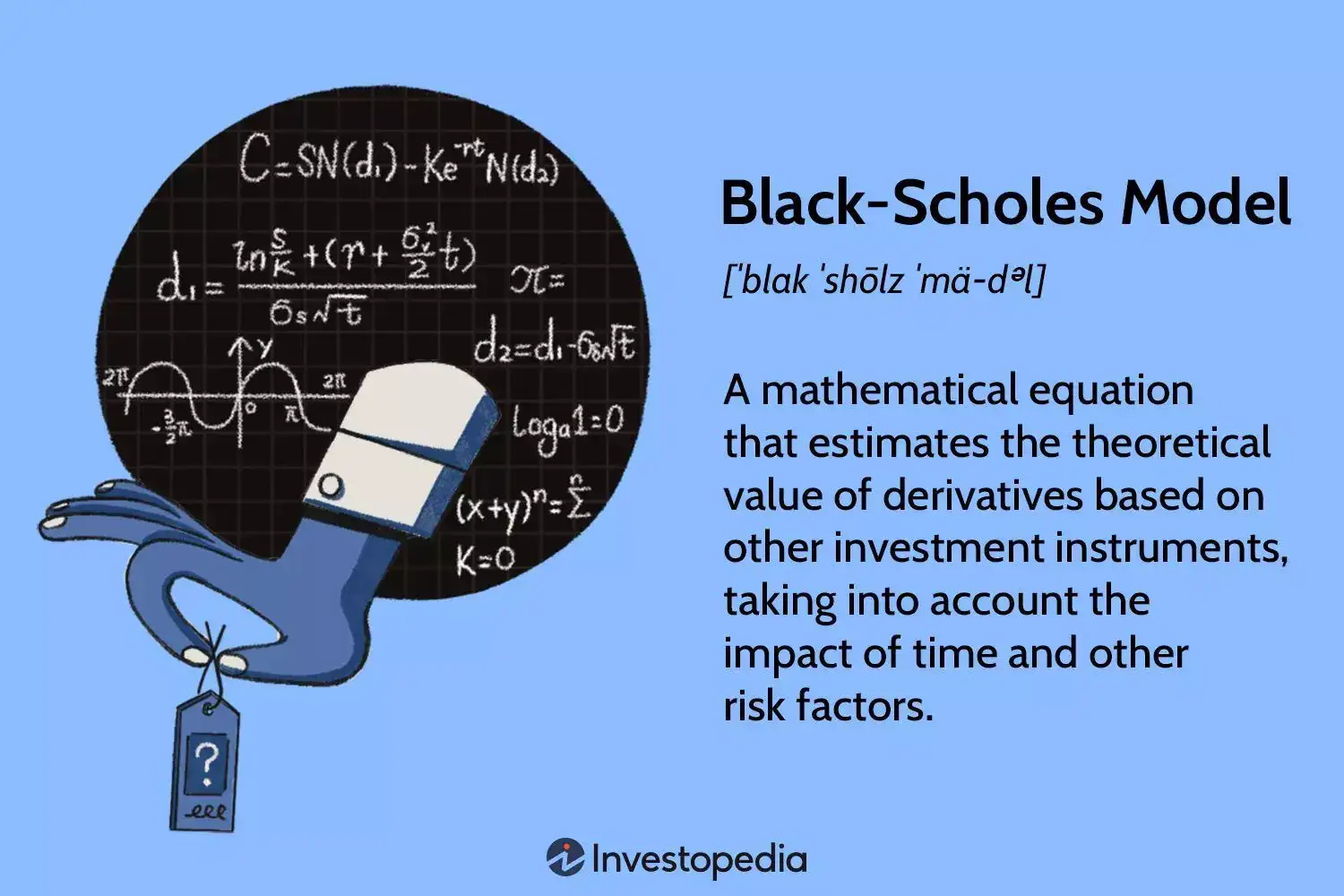

Financial word of the day: Black-Scholes model — meaning, usage, and the formula still powering Wall Street’s options pricing in 2026

Financial word of the day: Black-Scholes model — The Black-Scholes model remains the 2026 gold standard for pricing trillions in derivatives. It uses five key data points: stock price, strike, time, interest rates, and volatility. This math-heavy formula eliminated guesswork, creating today’s liquid markets. Traders rely on its "Greeks" to manage risk instantly. Even with AI, Black-Scholes provides the essential fair-value benchmark for every call and put option traded globally.