Here Are The Cars That The Consumer Reports Testers Disliked Most In 2025

Consumer Reports tests dozens of cars every year at its Auto Test Center, and they're not all created equal. These cars drew the most thumbs down in 2025.

Consumer Reports tests dozens of cars every year at its Auto Test Center, and they're not all created equal. These cars drew the most thumbs down in 2025.

The all-electric 2026 Toyota bZ gets a midcycle refresh that brings more range, more power, and a new look.

If you want to be as efficient as you possibly can be, build yourself a nice aerodynamic recumbent velomobile with a small e-bike assist motor this summer.

Spoiler alert: Evoluto Automobili's remastered Ferrari F355 sounds phenomenal. The post Hear What a Ferrari F355 Restomod Sounds Like During a Tunnel Run appeared first on The Drive .

Mercedes and Airbus Corporate Helicopters have revealed their latest collaboration

It took 3,000 hours to develop, and each of the 199 being made take 300 hours to build.

The 1985 Chevrolet Camaro IROC-Z helped pull the auto industry out of the Malaise Era, delivering over 200 hp and helping ignite the modern horsepower wars.

Shock value programming appears to be losing steam whether Kilmer decides to actually quit or not

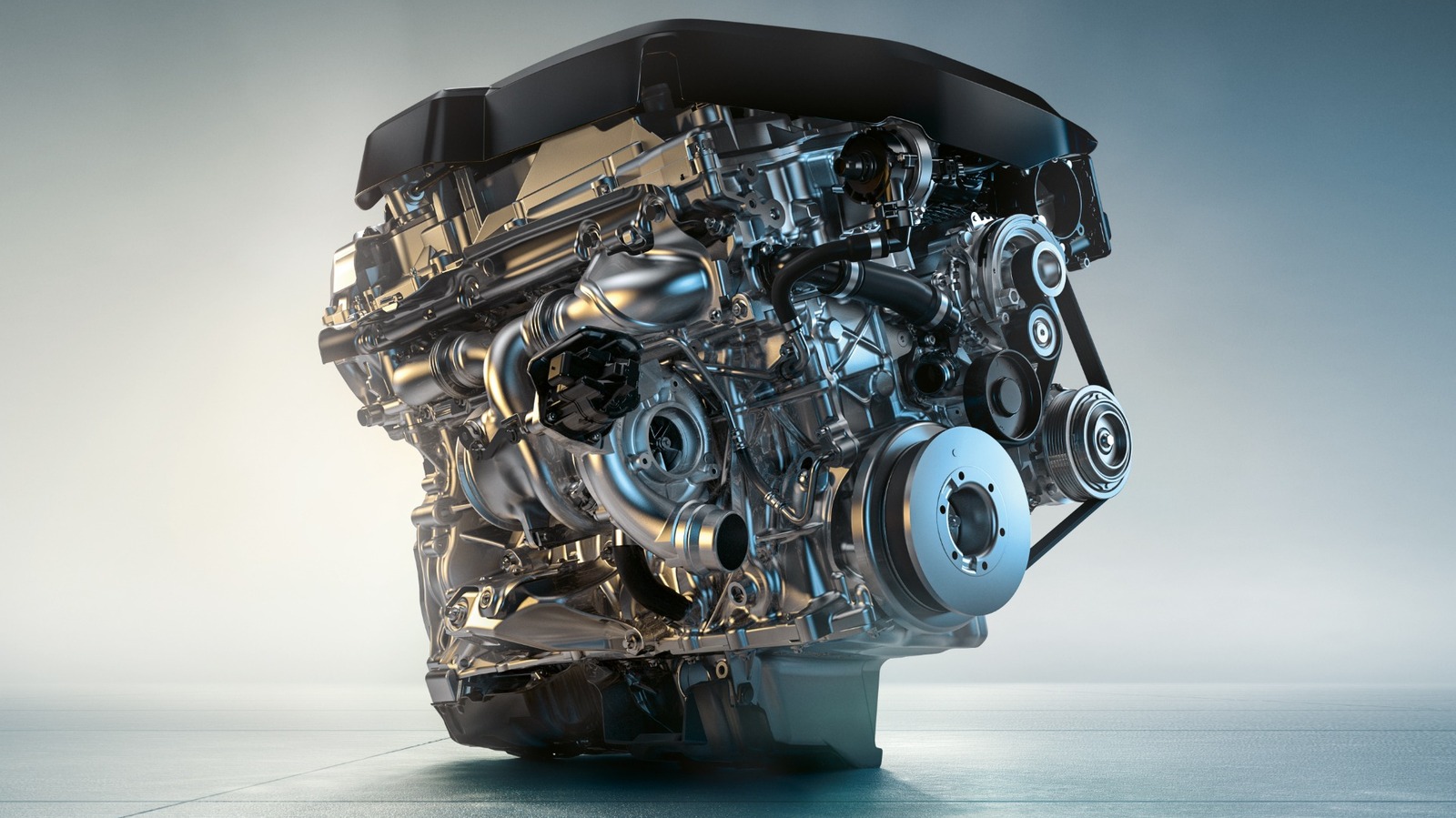

A dual turbo setup can deliver a lot of power, but the performance increases can come at a cost. Here's why BMW has opted for a single turbo engine in the past.

Here’s the story of how a secret meeting of car companies led to a new, growing EV charging network.

Thanks to technology, your tires could snitch on you. The post Every Car Made After 2008 Has the Same Digital Security Risk appeared first on The Drive .

With conflict looming in the Middle East, the FIA is closely monitoring the upcoming testing dates and the Middle Eastern-based rounds four and five.

Public opinion poses all sorts of problems for car development and marketing, and it goes way beyond politics, a researcher says.

Traffic lights might seem like they let cars stop or go randomly, but that's not always the case. Many of them use special sensors that detect vehicles.

The NASCAR legend and Chevy loyalist is putting the 1,250-hp flagship 'Vette in his garage. The post Watch Jeff Gordon Build a Chevy Corvette ZR1X Engine appeared first on The Drive .

The Geely Starray EM-i is one of the best mid-size plug-in hybrid SUVs on sale at this price point