Porsche's New 7-Seat SUV Will Share Platform And Engine With Audi Q9: Report

Porsche is giving its electric full-size SUV a rethink, with a report suggesting it will now be twinned with the ICE-powered Audi Q9.

Porsche is giving its electric full-size SUV a rethink, with a report suggesting it will now be twinned with the ICE-powered Audi Q9.

Chery questions the future of full-size American pickups in Australia as emissions rules tighten and mid-size utes dominate sales charts

The MAC-26 will be a rolling homage to Mario Andretti, who has contributed so much to F1, as well as the Cadillac team. The post Classy: Cadillac F1 Honors Mario Andretti With Chassis Codename appeared first on The Drive .

DfT data shows there are more than 116,000 public EV chargers, on top of the thousands of home wallboxes nationwide

The all-wheel-drive M2 is nearing launch, alongside an M Performance version of the Neue Klasse 3 Series. The post BMW Just Leaked Unannounced M Cars on Its Own Website appeared first on The Drive .

A preview of 2027 model year BMWs went live on BMW's website ... before going offline shortly thereafter.

The number is the brand's worst since it began to move into higher-volume markets over a decade ago.

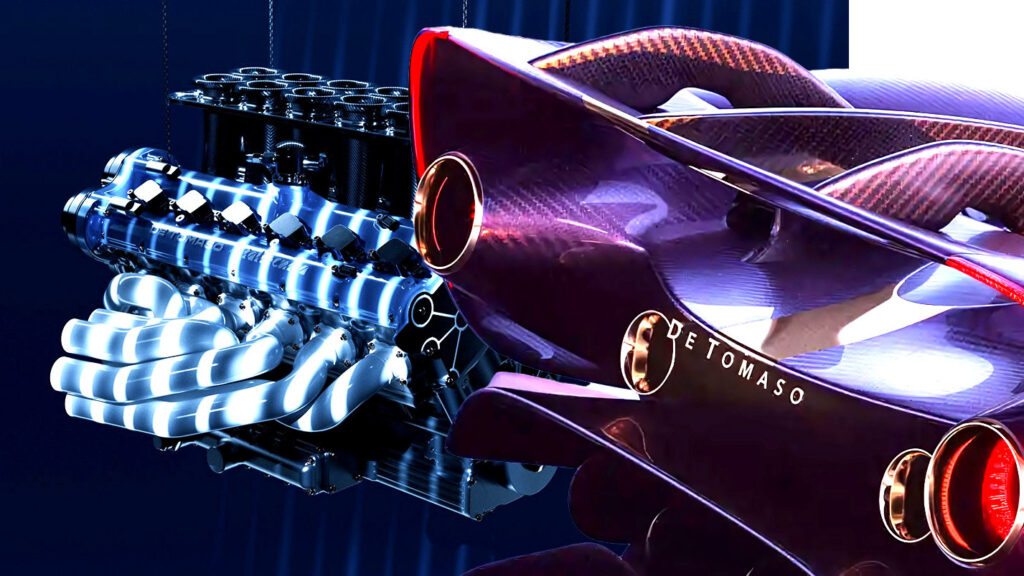

The supercar is inching closer to production and an updated design will debut later this year

More than 100 BMWs were lost in the grass fire that resulted in nearly $2 million in property damage, consumed 10 acres, and shut down a local highway.

The Saab Aero X was never destined for production, but its design, tech, and attitude reshaped Saab’s identity at a critical moment.

Review, Pricing, and Specs

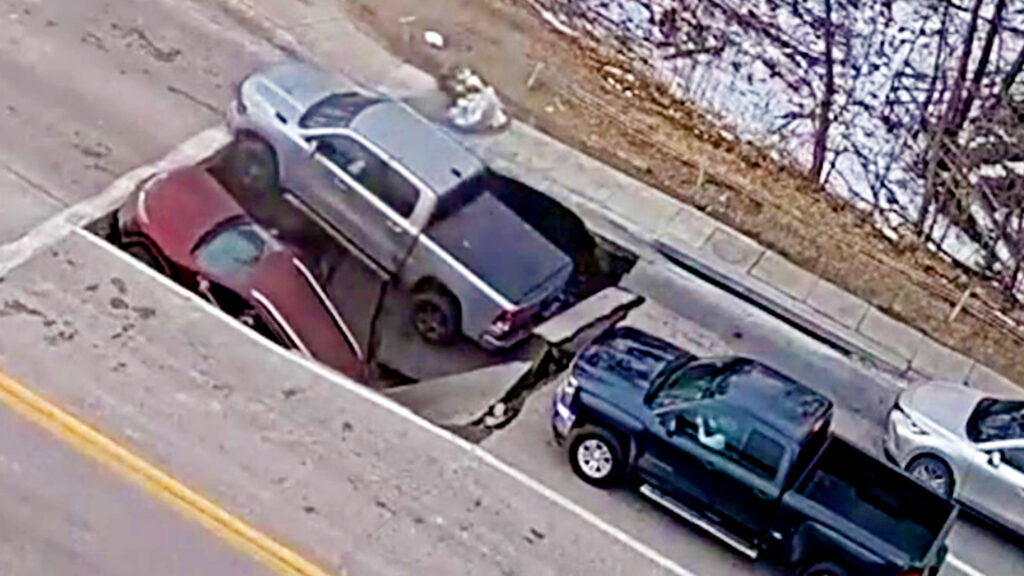

Two vehicles were swallowed up by an unexpected sinkhole in Omaha

Some of our readers definitely have unique pieces of automotive-themed decor on display.

Could Rivian's extreme off-road division one day eclipse Ford's Raptor and Ram's TRX?

Juggling under the hood of Porsche's biggest SUV, and another Ford recall (no, not yesterday's, a new one)